Buying verus Selling a Put

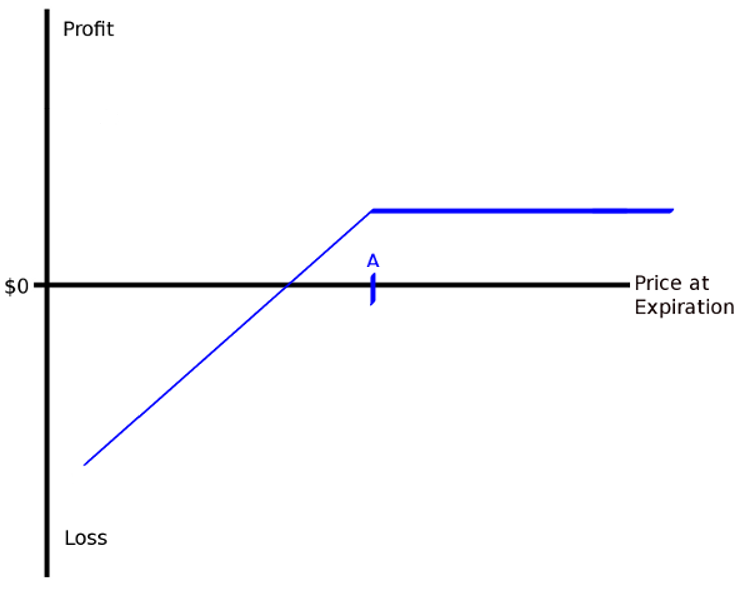

At the core of options trading is the put option. The put option gives the buyer of the option, for a fixed premium amount, the "right to sell, but not the obligation".

In other words, the owner of a put option, who also owns stock, is protected from a decline in prices (the degree of protection is determined by the terms of the option such as strike and month).

If the investor does not own stocks, the investor will profit from a sharp decline in stocks without realizing a loss in a stock portfolio.

On the other hand, the Seller of the put option, who collected a fixed amount in premium, will bear a loss if stocks fall sharply.

What if the market does not fall sharply, but instead rises or merely trades sideways?

In these alternate scenarios, the seller of the put would collect or earn the premium collected from the put buyer for taking the risk of loss if the market does not fall below the strike price of the option.

|

Time Decay (Theta)

A major feature of options is that they decay over time. Part of the value of an option is the amount of time left until expiration. As the option gets closer and closer to expriration, the value of the option erodes to "intrinsic value", which is the value in the money.

In the case of out of the money options, the value of the option decays to zero at expiration.

Time decay accelerates as expiration approaches. Options with less than 30 days until expiration have less premium and decay at the fastest rate but will also be the most volatile.

|

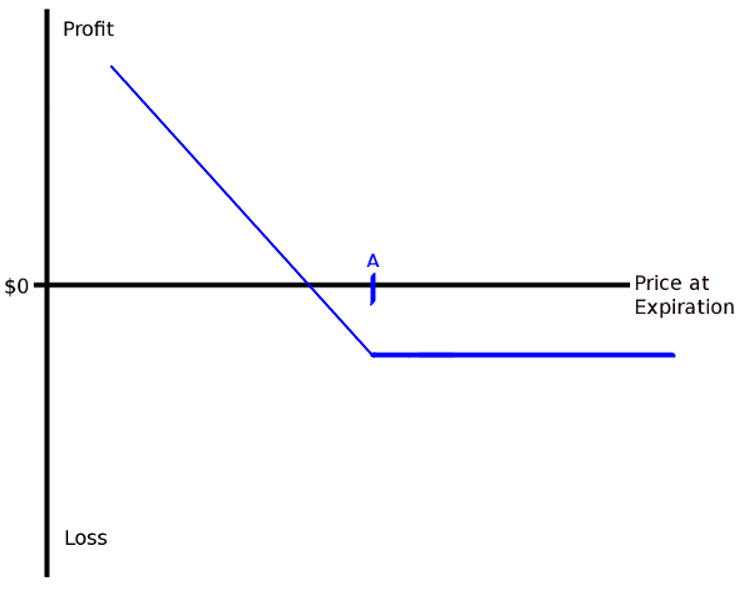

Limited Reward, Unlimited Risk

Selling options to collect premium is a strategy that comes with its own unique risks that must be understood before investing.

While buying an asset exposes theoretical unlimted upside for a fixed investment amount, the seller gets the inverse or theoretical unlimted downside for a fixed amount of reward.

With options, the buyer pays a fixed premium and hopes to make a return but can lose no more than what he or she paid for the option.

The seller of the option can only earn the premium collected from the buyer and hopes the buyer does not earn a large return because the seller is exposed directly and without limit.

The seller is exposed to unlimited risk of loss unless he or she uses other purchased options to protect and limit this exposure.

While the seller is exposed to the the unlimted risk, the fact that he or she collects premium up front and at a desired strike price helps the seller weigh the risks to the reward when deciding whether the unlimited theoretical risk is worth the fixed amount of reward.

|

Delta: "Size of the option"

Delta is the measure of an options sensitivity to a change in price of the underlying asset.

Delta give the investor an idea of the current relative exposure to the directional move of the underlying asset.

Long "Deltas" benefit from rising prices and short "Deltas" benefit from falling prices.

Non-directional traing strategies seek to maintain a neutral delta close to zero to hedge price moves in either direction.

|

Gamma: The Speed of Change

Gamma is the mesure of the rate of change of delta per change in the underlying.

Frequently overlooked or ignored, gamma can be a very important concept to understand in order to avoid large sudden losses due to adverse moves.

Gamma is greatest in at the money options in every month and increases as time approaches expiration.

Because of gamma and the speed that an option can increase in size, small out of the money options in the last 30 days that go in the money can be the most dangerous in terms of financial risk of loss to an option seller.

|

Volatility and Vega

Volatility is a statistical measure of the variability of returns or prices in the underlying asset.

In general, the more a market or underlying is expected to move, the higher the volatility.

Higher volatility translates directly into higher option prices as investors price in the risk of larger moves.

Options with more time are affected at a higher rate by changes in volatility because of the higher possibility, over more days, of large daily moves.

"Vega" is the measure of change theoretically expected for an increase of 1% in volatility.

Options sellers like to short or sell options in high volatility to take advantage of "high" premiums and attractive break even levels.

Option sellers generally avoid selling options in "low" volatility because the premium levels are too low and would not reward the seller enough to justify the theoretical or expected risk exposed.

|